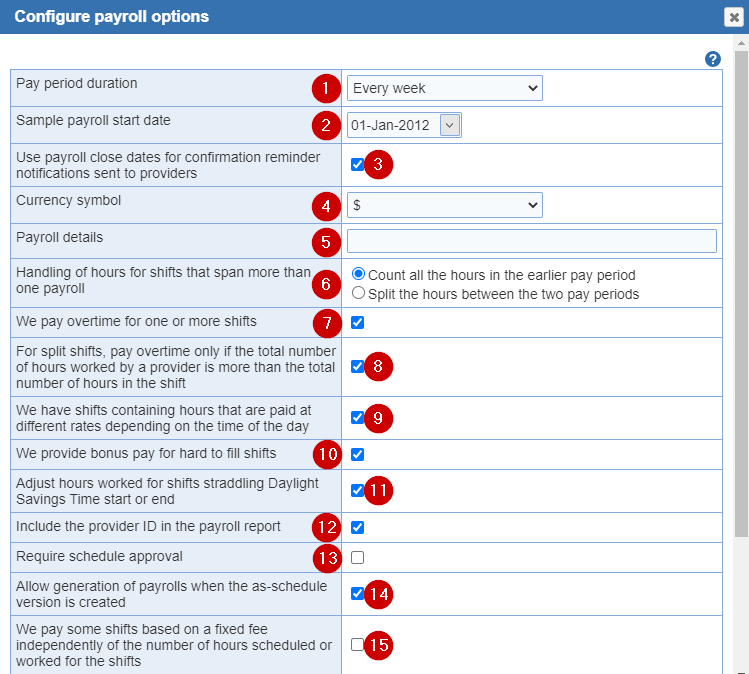

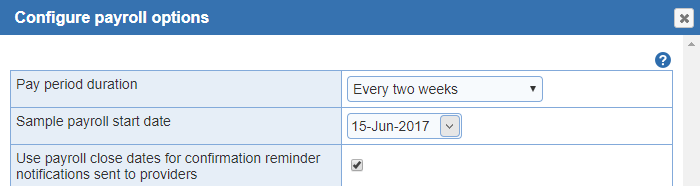

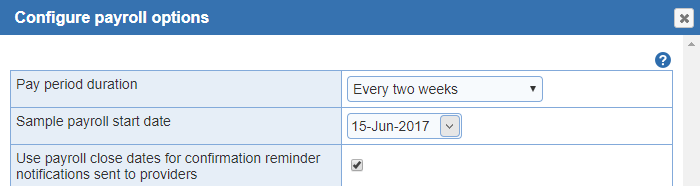

Define the payroll options at the current location.

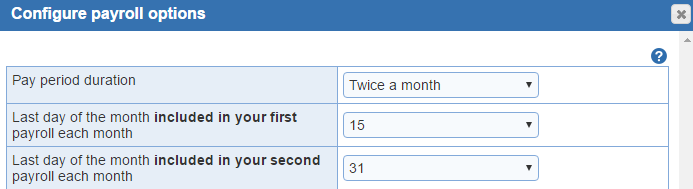

- Pay period duration: Creates pay periods for 'Monthly', 'Twice a month', 'Every week', 'Every two weeks', and 'Every four weeks'

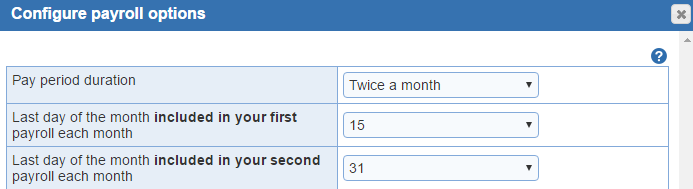

If you select 'Twice a month' as your payroll period, additional entry areas appear allowing you to designate the 'Last day of the moth included in your first payroll each month' and the 'Last day of the month included in your second payroll each month'. Bimonthly payroll is typically paid on the first and fifteenth day of the month, but does not include hours worked up until those dates since time is needed to prepare the payroll. For example, payroll on the first of the month might include hours worked from the 25th day of the prior month through the ninth day of the current month, and payroll on the fifteenth might then include hours worked from the 26th day of the prior month through the tenth day of the current month. The 'Twice a month' payroll period end days menus allows you to designate the cutoff date for each of the two payroll periods in the month.

- Sample payroll start date: Click the drop down menu and select the date of the first day of any prior or future payroll period. The actual date does not matter as long as it is correctly identifies the date of the first day of any payroll period.

- Use payroll dates for confirmation reminder notifications sent to providers: (Optional) This option applies to 'Every week', 'Every two weeks' and 'Every four weeks'.

- Currency symbol: Indicate your currency from the following: United States $, Canadian C$, Euro €, United Kingdom £, China ¥

- Payroll details: (Optional) Payroll detail information can be included payrolls. The details are pre-populated for each saved payroll.

- Handling of hours for shifts that span more than one payroll:

- Count all the hours in the earlier pay period

- Split the hours between the two pay periods

Many emergency departments have shifts that start before midnight of one day and end in the next day, with the hours of a single shift worked in two separate days. If the first part of this shift is worked on the last day of a payroll period, the remaining hours of the shift (those after midnight) are technically worked in the first day of the subsequent payroll period. Different groups vary in how these hours are paid, since they could reasonably be included either in the payroll period in which the shift started or in the actual payroll period in which the hours were worked. ByteBloc allows you select one of these two options your group uses.

- We pay overtime for one or more shifts: Some groups pay more than the usual base pay for hours worked beyond the normally scheduled hours of a shift.

Important note: 'Overtime' in ByteBloc refers to hours worked beyond the normally scheduled hours of a shift. It does NOT refer to extra hours worked in a given week, two weeks, month or other period of time.

Selecting the 'We pay overtime for one or more shifts' option check box changes the ByteBloc display in two ways:

Two additional check boxes are displayed in the 'Overtime' setup area, stating, 'For split shifts, pay overtime only if the total number of hours worked by a provider is more than the total number of hours in the shift' and 'We have shifts containing hours that are paid at different rates depending on the time of the day.'

- For split shifts, pay overtime only if the total number of hours worked by a provider is more than the total number of hours in the shift: Select this option if you want the hours worked in a split shift to be paid at an 'Overtime rate' ONLY if the total worked hours by a provider in a split exceed the total hours in the shift when it is not being split. If this check box option is NOT selected, hours worked beyond the normal beginning or ending shift times will be paid at an 'Overtime rate' if an applicable 'overtime payroll category' has been defined. If this check box option is NOT selected, hours worked beyond the normal beginning or ending shift times will be paid at an overtime rate if an applicable overtime payroll category has been defined.

In the 'Define Pay Categories' screen, when setting up your summary categories you will have the option of defining overtime payroll categories, such as 'Overtime Night Hours', which allows you to set the pay rate for each provider when they work beyond the normally scheduled hours of a night shift.

- Example: The scheduled hours for a shift are 6:00 a.m. - 3:00 p.m. Suppose that Dr. Brown and Dr. Smith have split this shift with Dr. Brown scheduled from 6:00 a.m. - 10:00 a.m., and Dr. Smith from 10:00 a.m. - 3:00 p.m. Overtime is paid at 1.5 times the 'Base pay' rate. You have checked 'We pay overtime for one or more shifts', and created a 'Base pay Overtime Hours' (Total Overtime Hours) payroll category. If it is busy and Dr. Smith ends up working 10:00 a.m. - 5:00 p.m., the two hours worked from 3:00 p.m. - 5:00 p.m. are paid depending upon whether the 'For split shifts, pay overtime only if the total number of hours worked by a provider is more than the total number of hours in the shift'.

- We have shifts containing hours that are paid at different rates depending on the time of the day: These shifts straddle pay categories.

- Example: Some groups pay at a higher pay rate for working night hours, but pay this rate only for the hours worked between 10:00 p.m. and 6:00 a.m. If a group's night shift is a twelve hour shift scheduled from 9:00 p.m. to 9:00 a.m., the hours worked from 9:00 p.m. to 10:00 p.m. and from 6:00 a.m. to 9:00 a.m. (total of four hours) would be paid at the normal hourly rate, while the eight hours worked from 10:00 p.m. to 6:00 a.m. would be paid at the higher night pay rate. If your group does something similar for weekends, nights, holidays, etc., please select this option.

- When this check box option is selected, the 'Define Pay Categories' screen will offer the option of defining the start and end times to which each payroll category applies. For the example above, you would create a 'Night Hours' payroll category, allowing you to set the pay rate for each provider when they work a night shift with hours that fall between 9:00 p.m. and 6:00 a.m.

- Important Note: If you elect to include only some of the hours of a shift in a payroll category, ByteBloc's summary of hours worked may be different from the hours calculated for payroll purposes. For example, the normal ByteBloc summary allows you to total Night Hours worked in your night shifts, but does not allow subdivision by specific times as is offered by the 'Handling of hours for shifts that span more than one payroll' setup option.

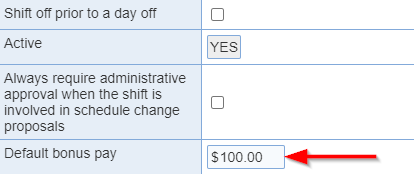

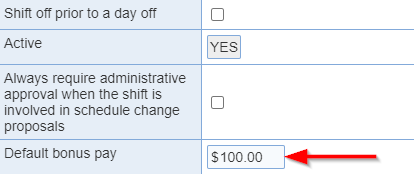

- We provide bonus pay for hard to fill shifts: A default bonus pay can be defined at the level of a 'shift' or 'Edit hours or assignment'.The bonus pay is added to the hourly based pay computed for providers. For shifts that are split, the bonus pay is prorated between the providers who worked the shift. The default bonus pay carries over to the corresponding shifts in each new schedule.

- Adjust hours worked for shifts straddling Daylight Savings Time start or end: Automatic adjustments for daylight savings time. When this option is enabled, the duration of shifts that straddle daylight savings time is adjusted automatically. Such shift are lengthened by one hour for the fall transition and shortened by one hour for the spring transition.

- Include the provider ID in the payroll report: (Optional) This can be used as a unique identifier or you can use an employee id to track. To report, enter an external id within the 'Staff' > 'Edit User' > 'Privileges' tab for each provider.

- Require schedule approval:(Optional) The generation of payrolls can be conditioned on the approval of the final hours for schedules. Once this option is enabled, it will be available to use within the 'Manage' screen. The most current version of the schedule will be used to generate payroll. Note that you cannot choose a version.

- Allow generation of payrolls when the as-schedule version is created: (Optional) The payroll module can be configured to allow the generation of payrolls as soon as an as-scheduled schedule is available without an associated as-worked schedule.

- We pay some shifts based on a fixed fee independently of the number of hours scheduled or worked for the shifts: (Optional) This option allows the computation of compensation amounts based on shifts scheduled or worked, independently of the number of hours scheduled or worked for the shifts.

When it is set, hourly compensation can still be specified for relevant shifts. When shift-based compensation is allowed, pay can be defined that are based on categories that count shifts. These pay rates are in addition to those based on categories that count hours and that correspond to hourly compensation. The amount of pay for shift-based rates are attributed to providers as follows:

1.) If the shift is assigned to a single provider, the amount of pay is attributed fully to the provider as long as the rate applies. If the pay rate is set on an 'As-Scheduled' basis, it is sufficient for the provider to be assigned to the shift to receive the pay, even if the provider does not work the shift. For 'As-worked' pay rates, the provider will receive the full pay specified for the rate if they work any portion of the shift.

Example: A pay category is based on a call 'As-Scheduled' shift category. The corresponding rate is set to $100. A provider solely assigned to the shift receives an amount of $100 whether or not they work part or all of the shift.

2.) If the shift is split, the amount of pay is prorated based on the rates set for the providers. The pro-ration is computed as the fraction of the shift scheduled or worked by each provider relative to the total number of hours scheduled or worked by all providers involved in the split, times the rate set for each provider.

Example: A pay category is based on an as-worked shift category with corresponding rates of $100 for provider Jones and $150 for provider Smith. Provider Jones works 4 hours of the shift and provider Smith 6 hours. Provider Jones receives $100 * 4 / (4 + 6) = $40 and provider Smith receives $150 * 6 / (4 + 6) = $90.

- Disallow double pay for the same hours: (Optional) An option is available that disallows double pay for shifts with overlapping worked hours.

Example: If a provider works 2 shifts with overlapping hours, they will get paid at the highest possible rate for the hours but each hour will get paid only once.

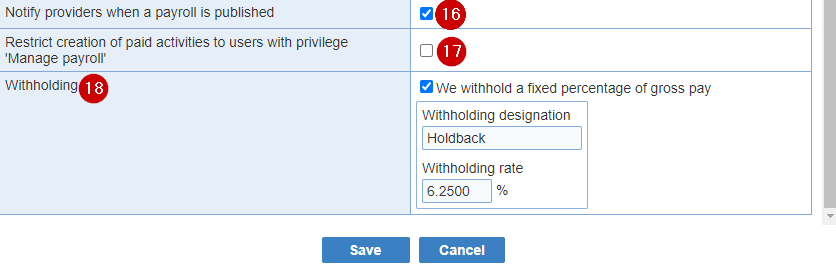

- Notify providers when a payroll is published: (Optional) Providers can be notified automatically when a payroll is published.

- Restrict creation of paid activities to users with privilege 'Manage payroll': (Optional) Disable 'Paid Activities' in the 'Payroll portal' for providers

- Withholding: (Optional) Withheld pay can be computed as a percentage of gross pay.

Note: You can modify your custom 'Withholding designation' title.